puerto rico tax incentives 2020

A short time. The Act codifies incentives granted for diverse purposes throughout decades with the aim to foster economic development more effectively.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Companies opted to move their operations abroad seeking the tax benefits Puerto Rico.

. These have mainly come in the form of tax incentives Act 20 and Act 22 but there are a number of other minor incentive acts in place. Puerto Rico tax and incentives guide 2020 5 Although economic growth has decreased during the last years Puerto Rico offers tax incentives packages which can prove attractive to companies from the United States and other countries. Act 20 Tax Incentives 4 corporate tax rate plus big exemptions.

As soon as the bookings open for the tickets golf enthusiasts from all over the world start pouring into Puerto Rico to get a chance to see their favorite golf players in action. When I wake up and see the ocean in front of me I have to pinch myself. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world.

Just declaring the US territory your new home is not enough. Fixed Income tax rate of 4. The Incentives in a Nutshell Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity.

Pay only 4 corporate income tax. With the repealing of the 936 tax incentives Puerto Rico lost its market share in the pharmaceutical industry. Ultimate Guide My Personal Experience With Act 20 Act 22.

Benefits of establishing relocating or expanding businesses in Puerto Rico. 73 of 2008 known as the Economic Incentives Act for the Development of Puerto Rico was established to provide the adequate environment and opportunities to continue developing a local industry offer an attractive tax proposal attract direct foreign investment and promote economic development and social betterment in Puerto Rico. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code.

Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Act 22 Tax Incentives 0 tax exemption on capital gains and interest. Puerto Rico offers tax incentives packages which can prove attractive to US mainland.

If we think back in March 2020 there was a scramble for drugs for ppe personal protective equipment there was a scramble for ventilators. The purpose of this Act is to provide incentives to individuals who have not been residents of Puerto Rico to become residents. The new Puerto Rico Incentives Code.

These include a fixed corporate income tax rate one. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. To benefit from the tax incentives you have to meet specific requirements though.

Move your business to Puerto Rico and pay only 4 corporate income tax. Puerto Rico Tax Incentives. FY 1977 FY 2020Program Accomplishments 19 Under 250000 27 25000 to 999999 28 1000000 to 4999999 02 5000000 to 24999999 6 Over 25 million FY 2020 Size of Projects Over 654 billion in private investment.

Automatic Compliance with Requirements under the Puerto Rico Incentive Code or Previous Tax Incentives Laws. Even some criminal tax cases seem likely. More importantly the requirements for each program have been adjusted.

Move yourself to Puerto Rico and pay 0 capital gains tax. A fixed corporate income tax rate one of the lowest in comparison with any US. As of January 1 2020 Act 20 and 22 have been replaced by Act 60 which brings with it some changes to the requirements.

This resulted in some adjustments to the qualification requirements among other changes. Published May 2019 updated July 2020. 60-2019 previous incentives laws or any special incentive law in Puerto Rico will be deemed to have complied with the following requirements contained in said grant as long as.

Pay 0 capital gains tax with the Act 60 Investor Resident Individual Tax Incentive. To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. Puerto Rico tax and incentives guide 2021 5 Puerto Rico offers tax incentives packages which can prove to be attractive to individuals and businesses from the United States of America US and other foreign countries.

For taxable year 2020 any holder of a tax incentives grant under Act No. 100 income tax exemption for distributions from earnings and profits. LAST UPDATED December 1 2020.

The Puerto Rico Golf Tournament is a very well-anticipated annual event that has people waiting for it every year. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. We have reviewed the language of the new law and are pleased to share the major changes to the Act 20 and 22 program below. On July 1 2019 the Governor of Puerto Rico converted House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Act.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. In order to encourage the transfer of such individuals to Puerto Rico the Act exempts from Puerto Rico income tax their passive income which may consists of interest dividends and capital gains. 28 May 2021.

Source income into Puerto Rico income. Act 22 or the Individual Investors Act targets high net worth investors with the promise of 0 tax on interest dividends and capital gains obtained while residing in Puerto Rico as a bona fide resident. Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020.

Act 27 Tax Incentives Big tax incentives for the film industry. 75 property tax exemption for real property used in the Export Business taxable portion subject to regular tax rate of up 1183. There is no doubt that Puerto Rico taxes offer incredible incentives to move to the island.

Lets look at the Puerto Rico tax benefits and how to qualify for them. Puerto Rico CPA Tax Incentives Puerto Rico. In 2020 a prominent Puerto Rico CPA was indicted and arrested over an alleged scheme to turn US.

A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US.

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Guide To Income Tax In Puerto Rico

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

The Puerto Rico Tax Haven Will Act 20 Work For You

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

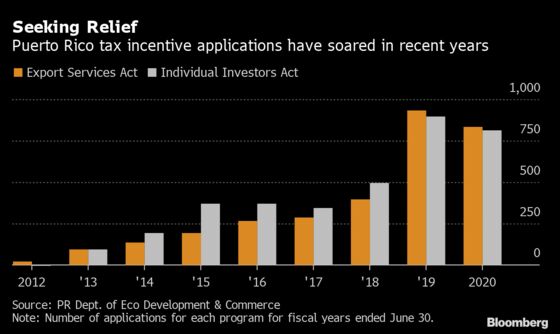

Hedge Funds Facing Biden Tax Threat Grab Toehold In Puerto Rico

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

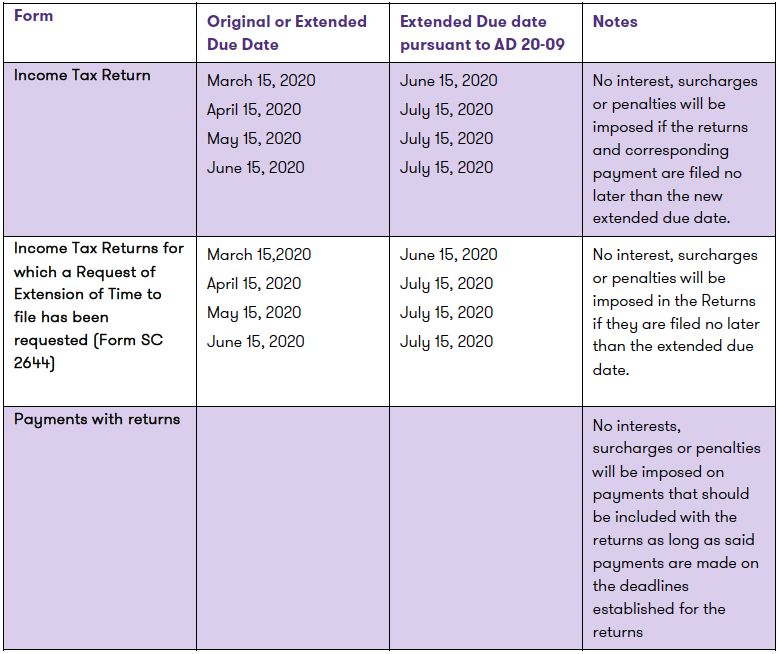

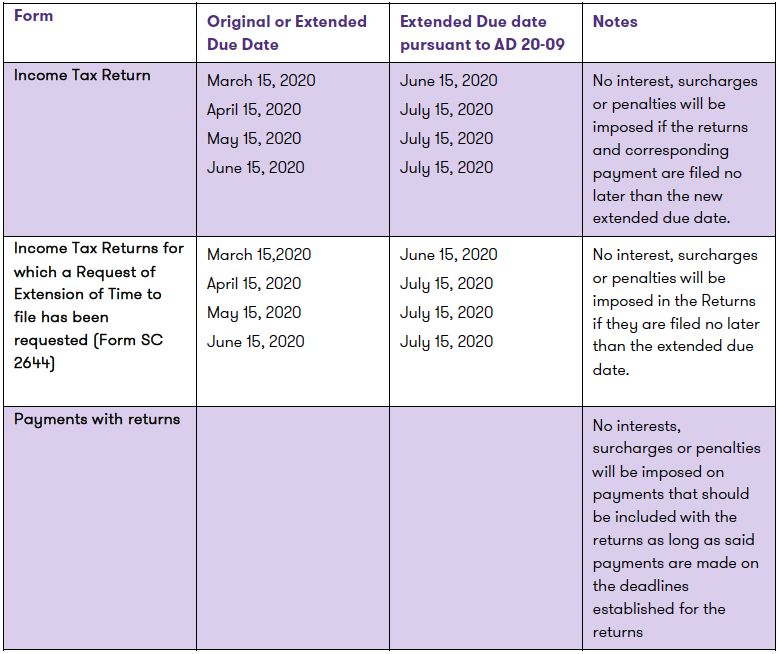

New Deadlines Established By The Puerto Rico Treasury Department Pursuant To Ad 20 09 Grant Thornton

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Guide To Income Tax In Puerto Rico

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist

Puerto Rico Tax Incentives Updated August 2020 Act 60 Replaces Act 20 Act 22 Youtube

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist